|

| Harris & Ewing Listening to the Future September 12, 1938 Washington, D.C. "Acting Czechoslovakian Minister listens to Hitler speech. Dr. Karel Brejska, Charge d'Affaires and acting Minister in the absence of Minister Vladimir Hurban in Czechoslovakia, is pictured listening to Adolf Hitler's radio address today at the legation. He refused to comment on the speech" |

By Ilargi

Hmm.

Right, markets are up. Wonder what they're so happy

about? A newfound source of suckers, perhaps, or the same old one that still

has some juice left? Yeah, US jobs numbers, housing numbers, yada yada, I know.

But does anyone with a sound mind have the guts to risk their wealth on that?

Merkel and Sarkozy are doing emergency meeting 1000, the next one, number 1001, is on January 20. What do they talk about by now? US jobs numbers? Hard to imagine.

Hungary perhaps? It’s fast becoming a major threat to Europe's finances, since Austrian banks are deeply embedded in the country. And in Bulgaria, Romania.

And the Magyar government pushes through one new law after the other, including some concerning the central bank that the IMF and EU don't like one bit. The central bank's independence is under threat, is their complaint. But can anyone name even one example where the IMF stood up to protect a central bank's independence from the IMF? Or doesn't that count?

Hungary’s constitution and democracy are "trampled on", say the headlines. Yes, well, what's new? Are we sure this indignation is well directed? For one thing, not that far from Budapest, Italy and Greece have installed unelected technocrat governments, under pressure from the same IMF and EU. Certainly undemocratic, and almost certainly contrary to their respective constitutions.

I have little sympathy for a government that also writes up new laws that take issues like abortion and gay rights on a journey back in time, but I do think we must ask ourselves who exactly is doing the trampling these days.

In America, anybody at all can now be arrested without any recourse at all, no lawyer, no trial, no formal accusation. Constitution, anyone? A few years back in Europe, a new EU constitution was voted down repeatedly by voters in several member countries. It still went through. Merkel and Sarkozy push hard to change that constitution again, to allow for a two thirds majority to suffice for far reaching "reforms". Democracy, anyone?

It's all just another power game, facilitated by the dire economic circumstances countries find themselves in. We live in the kind of times when the IMF and the World Bank dust off their shock doctrine playbooks, times they undoubtedly long saw coming, and precipitated where they could.

Hungary tries to fight back, and what it is fighting, in its own eyes, is debt slavery. Hungary is one of a growing list of countries that don't have access to international money markets. For them the IMF is the only game in town, and the IMF raises the stakes as the list grows and the countries grow more desperate, demanding ever more loot per dollar borrowed. Greece, Portugal, Ireland, and soon Italy, they depend on a thin veneer of Eurozone guarantees, and after that it's the IMF.

Loansharks International Ltd. Nice little country you got there, you wouldn’t want ......., would you? So, Budapest, do as we say: privatize your resources, shrink your social plans, and put up your national treasures as collateral. If we can do it with Greece, we can certainly do it with you, there’s no Eurozone protection coming your way.

Still, I’d bet Merkel and Sarkozy's main topic is once again Greece. And the extent to which its downfall will drag down Italy and France. They know it's not looking up, despite what the markets do or say.

Everyone including Athens' new technocrat Papademos knows that Greece could fall within weeks, unless it receives yet another bailout slice. Which is dependent on a deal made with investors through a PSI (Private Sector Involvement) agreement. Problem is, that deal keeps on changing, simply because it was never based on realistic assumptions. If a new deal is reached, it will again not be.

Last summer, the private investors signed off on a 21% haircut. Then it went to 50% in October. Now it’s over 50%, though no-one's willing to openly state how much. Yet. The show boxing goes on, as every party involved loses time that's very valuable to them. Every party but the IMF and its henchmen, that is. They watch with glee.

Patrick Jenkins and Richard Milne write in the Financial Times:

Merkel and Sarkozy are doing emergency meeting 1000, the next one, number 1001, is on January 20. What do they talk about by now? US jobs numbers? Hard to imagine.

Hungary perhaps? It’s fast becoming a major threat to Europe's finances, since Austrian banks are deeply embedded in the country. And in Bulgaria, Romania.

And the Magyar government pushes through one new law after the other, including some concerning the central bank that the IMF and EU don't like one bit. The central bank's independence is under threat, is their complaint. But can anyone name even one example where the IMF stood up to protect a central bank's independence from the IMF? Or doesn't that count?

Hungary’s constitution and democracy are "trampled on", say the headlines. Yes, well, what's new? Are we sure this indignation is well directed? For one thing, not that far from Budapest, Italy and Greece have installed unelected technocrat governments, under pressure from the same IMF and EU. Certainly undemocratic, and almost certainly contrary to their respective constitutions.

I have little sympathy for a government that also writes up new laws that take issues like abortion and gay rights on a journey back in time, but I do think we must ask ourselves who exactly is doing the trampling these days.

In America, anybody at all can now be arrested without any recourse at all, no lawyer, no trial, no formal accusation. Constitution, anyone? A few years back in Europe, a new EU constitution was voted down repeatedly by voters in several member countries. It still went through. Merkel and Sarkozy push hard to change that constitution again, to allow for a two thirds majority to suffice for far reaching "reforms". Democracy, anyone?

It's all just another power game, facilitated by the dire economic circumstances countries find themselves in. We live in the kind of times when the IMF and the World Bank dust off their shock doctrine playbooks, times they undoubtedly long saw coming, and precipitated where they could.

Hungary tries to fight back, and what it is fighting, in its own eyes, is debt slavery. Hungary is one of a growing list of countries that don't have access to international money markets. For them the IMF is the only game in town, and the IMF raises the stakes as the list grows and the countries grow more desperate, demanding ever more loot per dollar borrowed. Greece, Portugal, Ireland, and soon Italy, they depend on a thin veneer of Eurozone guarantees, and after that it's the IMF.

Loansharks International Ltd. Nice little country you got there, you wouldn’t want ......., would you? So, Budapest, do as we say: privatize your resources, shrink your social plans, and put up your national treasures as collateral. If we can do it with Greece, we can certainly do it with you, there’s no Eurozone protection coming your way.

Still, I’d bet Merkel and Sarkozy's main topic is once again Greece. And the extent to which its downfall will drag down Italy and France. They know it's not looking up, despite what the markets do or say.

Everyone including Athens' new technocrat Papademos knows that Greece could fall within weeks, unless it receives yet another bailout slice. Which is dependent on a deal made with investors through a PSI (Private Sector Involvement) agreement. Problem is, that deal keeps on changing, simply because it was never based on realistic assumptions. If a new deal is reached, it will again not be.

Last summer, the private investors signed off on a 21% haircut. Then it went to 50% in October. Now it’s over 50%, though no-one's willing to openly state how much. Yet. The show boxing goes on, as every party involved loses time that's very valuable to them. Every party but the IMF and its henchmen, that is. They watch with glee.

Patrick Jenkins and Richard Milne write in the Financial Times:

Greek bondholders poised to accept higher lossesHolders of Greek bonds are set to accept higher losses as the contentious negotiations over writing down Athens’ debt burden come to a head in the next week.

People involved with the discussions about so-called private sector involvement, or PSI, said that bondholders were likely to suffer a haircut of 55-60%, more than the 50% originally agreed in October.

Both the IMF and Greece have argued that October’s deal should not only be maintained but also toughened while bondholders and elements of the European Central Bank have proposed watering down or even scrapping the idea. [..]

The concept of PSI has been debated for months and has been through two main iterations so far, with an initial plan to trim the net present value of bondholders’ investments in Greek sovereign debt by 21% last summer overhauled to involve a 50% nominal reduction in the value of the holdings by October.

Details were never thrashed out, however, so the maturities of Greece’s new debt issues and the coupons payable have not been decided, although it is generally accepted that new bonds should have 20-30 year durations, with coupons of 4-5%, probably with some upfront discounts for an initial few years. [..]

Policymakers and bondholders are keen that Greece remains a unique case and that further eurozone sovereign debt restructurings are ruled out. One person said Portugal was a possibility "but everyone realises it can’t happen in Italy".

Questions are also being raised about the ECB’s estimated €45 billion of Greek sovereign holdings. Collective action clauses are likely to be introduced into Greek bonds by the PSI deal, leaving the ECB – which has said it will not participate in the voluntary restructuring – potentially in an uncomfortable position in the future. "The ECB’s holding will be the story to watch in the next few months," a person close to bondholders said.

Advisers said agreement on a deal was necessary in the next week or so because implementation of such a complex debt exchange would take many weeks. Greece needs to complete it before its next big refinancing in March.

The parties truly in the know realized long ago that

the bonds being discussed were not worth anything at all anymore, even before

the summer 2011 deal was struck. That's why the "Details were

never thrashed out". There is money to be made in the slow squeeze of

Greece. And, not to forget, of the ECB, i.e. the European citizen. And all

other greater fools stuck with empty bags full of useless paper.

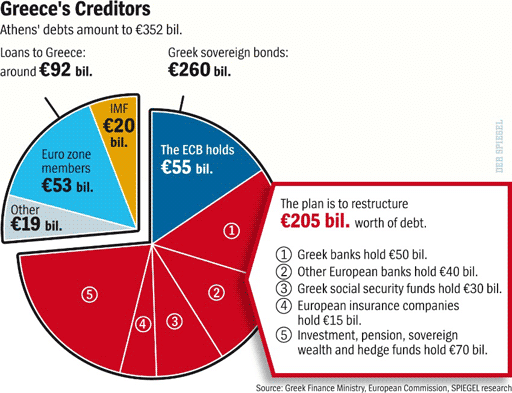

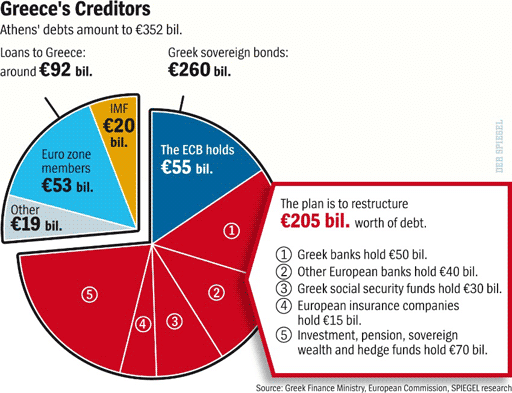

Der Spiegel ran this graph:

Obviously, the plan is to restructure the part held by the private sector, not the ECB. Or the EU. And certainly not the IMF.

So Greek banks will lose about €30 billion. Other European banks some €25 billion. Greek social security funds are to lose close to €20 billion. Good luck with that retirement, Zorba. Well, these are at least the amounts presently talked about. For no good reason other than shadow boxing those not at the table into ever bigger losses.

Sven Böll, Martin Hesse and Julia Amalia Heyer wrote the piece that goes with the graph for Der Spiegel:

Doubts Grow over Greek Debt Restructuring

Der Spiegel ran this graph:

Obviously, the plan is to restructure the part held by the private sector, not the ECB. Or the EU. And certainly not the IMF.

So Greek banks will lose about €30 billion. Other European banks some €25 billion. Greek social security funds are to lose close to €20 billion. Good luck with that retirement, Zorba. Well, these are at least the amounts presently talked about. For no good reason other than shadow boxing those not at the table into ever bigger losses.

Sven Böll, Martin Hesse and Julia Amalia Heyer wrote the piece that goes with the graph for Der Spiegel:

Doubts Grow over Greek Debt Restructuring

Two years after the crisis began, the Greek tragedy is

reaching a new climax. The economic data are distressing, the reforms are

progressing very slowly, and now negotiations with private lenders on a

voluntary writedown of Greek government bonds appear to be on the rocks.

The Greek economy was actually expected to shrink by only 3% in 2011. But according to current calculations the contraction was closer to 6%. Hopes that the economy will regain strength in 2012 will probably remain unfulfilled. Instead, it will most likely continue its downward slide -- for the fifth year in a row. It is becoming more and more apparent that without general debt relief that includes all groups of creditors, from private banks to the ECB, Greece will hardly be able to free itself from its predicament.

But the Greek government and the so-called troika, consisting of the European Union, the IMF and the ECB, are determined to stick to their current strategy. [..]

According to an internal document, the troika sees three possibilities: Either the Greeks must impose even tougher austerity measures, or private creditors must accept a larger debt haircut or the country's creditors must provide Greece with additional funds.

The troika document also says that the administration in Athens is falling far short of the agreed reform targets. For example, the troika notes that Greece is not sufficiently complying with its promise to collect more taxes, while the proceeds from the country's privatization program are well below expectations.

Last fall, the IMF and the EU determined that Greece's debt would have to be cut to 120% of GDP to be sustainable. The country's debt was to be reduced to this level by 2020, and to a lower level in subsequent years. But now the IMF recognizes that this is probably not possible. In any case, even a debt-to-GDP ratio of 120% could still be too high.

In a report released last August, IMF economists concluded that emerging economies could support maximum debt levels of 63 to 78% of GDP in the long term. "Now that they are confronted with the reality on a daily basis, the IMF people are realizing thatGreece, in structural terms, should really be classified as an emerging economy," says a senior official at Germany's central bank, the Bundesbank.

"When the most recent restructuring program was approved, it was already clear that the assumptions were unrealistic," says Oxford-based economist Clemens Fuest, an adviser to the German Finance Ministry. [..]

But the troika is not as honest as to admit the impossibility of its own mission. Instead, it continues to stall for time and is pinning its hopes on private investors coming around. Prime Minister Lucas Papademos expects the negotiations with private creditors on debt restructuring to be complete by mid-January. Otherwise, he warns, Greece could face the immediate threat of a disorderly bankruptcy in March, when €17.5 billion ($22 billion) worth of bonds will mature.

But the negotiations between Greece and the financial companies represented by the Institute of International Finance (IIF) are hanging in the balance. Although IIF Managing Director Charles Dallara recently said that progress was being made, he also made it clear that the lenders are not willing to take more than the agreed 50% haircut.

Other players are even more pessimistic. "There is not even a common negotiating position on the part of the lenders," says the representative of one participating German bank.

Besides, the investors also have highly diverging interests. For instance, hedge funds have bought up large numbers of bonds, some of which already mature in March. They have no interest in a debt restructuring. Insiders estimate that speculative investors could be holding up to €50 billion in Greek debt. And bankers, like Commerzbank CEO Martin Blessing, feel that a debt restructuring limited to private creditors is fundamentally wrong.

"The IMF is calling for up to 90% in debt relief," complains one banker -- a claim that sources in the IMF deny. But if the haircut is so large, there is a risk that, even if the lead negotiators are in agreement, not enough creditors will play along so that the targeted debt ratio of 120% can be reached.

Experts are convinced that real financial relief for Greece can only be achieved through a general debt writedown. But then the pretense of a voluntary restructuring could not be maintained. Both Europe's governments and the ECB would have to accept substantial losses, Greece could be forced to withdraw from the euro zone, and speculation against other crisis-stricken countries could escalate.

Nevertheless, even German politicians are slowly realizing that the current strategy is not sustainable. "It is quite possible that we will also have to write off some of the Greeks' debts," says Gerhard Schick, financial policy spokesman for the Green Party in the German parliament. "After all, it doesn't make sense to demand debt repayments that can never be made."

The Greek economy was actually expected to shrink by only 3% in 2011. But according to current calculations the contraction was closer to 6%. Hopes that the economy will regain strength in 2012 will probably remain unfulfilled. Instead, it will most likely continue its downward slide -- for the fifth year in a row. It is becoming more and more apparent that without general debt relief that includes all groups of creditors, from private banks to the ECB, Greece will hardly be able to free itself from its predicament.

But the Greek government and the so-called troika, consisting of the European Union, the IMF and the ECB, are determined to stick to their current strategy. [..]

According to an internal document, the troika sees three possibilities: Either the Greeks must impose even tougher austerity measures, or private creditors must accept a larger debt haircut or the country's creditors must provide Greece with additional funds.

The troika document also says that the administration in Athens is falling far short of the agreed reform targets. For example, the troika notes that Greece is not sufficiently complying with its promise to collect more taxes, while the proceeds from the country's privatization program are well below expectations.

Last fall, the IMF and the EU determined that Greece's debt would have to be cut to 120% of GDP to be sustainable. The country's debt was to be reduced to this level by 2020, and to a lower level in subsequent years. But now the IMF recognizes that this is probably not possible. In any case, even a debt-to-GDP ratio of 120% could still be too high.

In a report released last August, IMF economists concluded that emerging economies could support maximum debt levels of 63 to 78% of GDP in the long term. "Now that they are confronted with the reality on a daily basis, the IMF people are realizing thatGreece, in structural terms, should really be classified as an emerging economy," says a senior official at Germany's central bank, the Bundesbank.

"When the most recent restructuring program was approved, it was already clear that the assumptions were unrealistic," says Oxford-based economist Clemens Fuest, an adviser to the German Finance Ministry. [..]

But the troika is not as honest as to admit the impossibility of its own mission. Instead, it continues to stall for time and is pinning its hopes on private investors coming around. Prime Minister Lucas Papademos expects the negotiations with private creditors on debt restructuring to be complete by mid-January. Otherwise, he warns, Greece could face the immediate threat of a disorderly bankruptcy in March, when €17.5 billion ($22 billion) worth of bonds will mature.

But the negotiations between Greece and the financial companies represented by the Institute of International Finance (IIF) are hanging in the balance. Although IIF Managing Director Charles Dallara recently said that progress was being made, he also made it clear that the lenders are not willing to take more than the agreed 50% haircut.

Other players are even more pessimistic. "There is not even a common negotiating position on the part of the lenders," says the representative of one participating German bank.

Besides, the investors also have highly diverging interests. For instance, hedge funds have bought up large numbers of bonds, some of which already mature in March. They have no interest in a debt restructuring. Insiders estimate that speculative investors could be holding up to €50 billion in Greek debt. And bankers, like Commerzbank CEO Martin Blessing, feel that a debt restructuring limited to private creditors is fundamentally wrong.

"The IMF is calling for up to 90% in debt relief," complains one banker -- a claim that sources in the IMF deny. But if the haircut is so large, there is a risk that, even if the lead negotiators are in agreement, not enough creditors will play along so that the targeted debt ratio of 120% can be reached.

Experts are convinced that real financial relief for Greece can only be achieved through a general debt writedown. But then the pretense of a voluntary restructuring could not be maintained. Both Europe's governments and the ECB would have to accept substantial losses, Greece could be forced to withdraw from the euro zone, and speculation against other crisis-stricken countries could escalate.

Nevertheless, even German politicians are slowly realizing that the current strategy is not sustainable. "It is quite possible that we will also have to write off some of the Greeks' debts," says Gerhard Schick, financial policy spokesman for the Green Party in the German parliament. "After all, it doesn't make sense to demand debt repayments that can never be made."

"... it doesn't make sense to demand debt

repayments that can never be made". Indeed. But that's what we witness anyway. If you go

through the numbers, you can get an idea of what awaits the Greeks. Who've

often already lost 30-40% of their wages, and much else. Not nearly enough, is

today's word.

And you can bet that they’ll be squeezed further. It's therefore not hard to predict what will happen on the streets of Athens come summer. Or before.

Why is the 55-60% haircut still not enough? Tyler Durden had this last week:

CMA Now Officially Assumes 20% Recovery In Greek Default - Time To Change Sovereign Debt Risk Management Defaults?

And you can bet that they’ll be squeezed further. It's therefore not hard to predict what will happen on the streets of Athens come summer. Or before.

Why is the 55-60% haircut still not enough? Tyler Durden had this last week:

CMA Now Officially Assumes 20% Recovery In Greek Default - Time To Change Sovereign Debt Risk Management Defaults?

One of the ironclad assumptions in CDS trading was

that recovery assumptions, especially on sovereign bonds, would be 40% of par

come hell or high water. This key variable, which drives various other

downstream implied data points, was never really touched as most i) had never

really experienced a freefall sovereign default and ii) 40% recovery on

sovereign bonds seemed more than fair.

Obviously with Greek bonds already trading in the 20s this assumption was substantially challenged, although the methodology for all intents and purposes remained at 40%. No more - according to CMA [Credit Market Analysis Ltd], the default recovery on Greece is now 20%. So how long before both this number is adjusted, before recovery assumptions for all sovereigns are adjusted lower, and before all existing risk model have to be scrapped and redone with this new assumption which would impact how trillions in cash is allocated across the board?

Of course, none of this will happen - after all what happens in Greece stays in Greece. In fact since America can decouple from the outside world, it now also appears that Greece can decouple from within the Eurozone, even though it has to be in the eurozone for there to be a Eurozone. We may go as suggesting that the word of the year 2012 will be "decoupling", even though as everyone knows, decoupling does not exist: thank you 60 years of globalization, $100 trillion in cross-held debt, and a $1 quadrillion interlinked derivatives framework.

Obviously with Greek bonds already trading in the 20s this assumption was substantially challenged, although the methodology for all intents and purposes remained at 40%. No more - according to CMA [Credit Market Analysis Ltd], the default recovery on Greece is now 20%. So how long before both this number is adjusted, before recovery assumptions for all sovereigns are adjusted lower, and before all existing risk model have to be scrapped and redone with this new assumption which would impact how trillions in cash is allocated across the board?

Of course, none of this will happen - after all what happens in Greece stays in Greece. In fact since America can decouple from the outside world, it now also appears that Greece can decouple from within the Eurozone, even though it has to be in the eurozone for there to be a Eurozone. We may go as suggesting that the word of the year 2012 will be "decoupling", even though as everyone knows, decoupling does not exist: thank you 60 years of globalization, $100 trillion in cross-held debt, and a $1 quadrillion interlinked derivatives framework.

No comments:

Post a Comment